US Treasury Forgives Ukraine Looters!

About the author, John Christmas: I am a graduate of Dartmouth College and Cornell University. I used to be a banker, most notably the whistleblower against Parex Bank of Latvia, which was linked to Russian President Vladimir Putin in several ways. I am co-author of award-winning thriller ‘KGB Banker’ inspired by my whistleblowing saga. I wrote a previous piece for FinTelegram and the link is in this new piece.

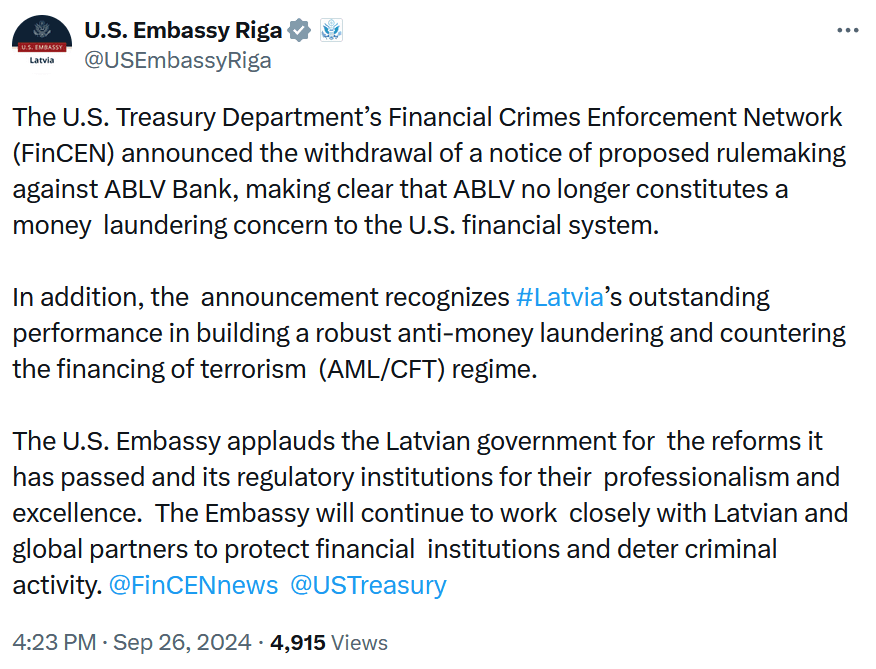

On 26 September 2024, the U.S. Treasury’s Financial Crimes Enforcement Network ‘FinCEN’ made the astonishing decision to drop sanctions against ABLV Bank of Latvia. ABLV was sanctioned in 2018 for a list of reasons, including helping Ukrainian President Viktor Yanukovich’s bagman, Serhiy Kurchenko, steal billions of dollars from Ukraine. This action triggered the violent ouster of Yanukovich, which was followed by the Russian invasions in 2014 and 2022.

Pictured is the X post by the US Embassy in Latvia announcing this decision. In this post, the US Embassy ‘applauds’ Latvia for ‘excellence’ in fighting money laundering.

As the exiled whistleblower against the Kremlin’s money launderers and bank embezzlers in Latvia, sometimes called the Latvian Proxy Network, I am horrified by the US Treasury decision and left wondering whether it was motivated by corruption, incompetence, ignorance, or all three?

The Latvian Money Laundering Operations

The reality is that Latvia is funding the money launderers, not fighting them. Clear evidence that Latvia is secretly paying the European Bank for Reconstruction and Development ‘EBRD’ (partly owned by the United States) to act as straw owner of Russian offshore banks is available from me (2009), the Latvian government’s consultant Nomura (2010), the Dutch Parliament (2014), Eurostat (2014 and 2018), and the Latvian Parliament (2014 and 2015). Despite piles of undisputed, almost everyone in the American government, Latvian government, and mainstream media is either fooled or playing a game of ‘plausible deniability’ while the corruption, fraud, and money laundering keep getting worse. I have written about this for FinTelegram with full referencing of evidence.

In 2004, I was employed by Parex Bank of Latvia. The US Embassy asked me for information about Parex since they believed it was involved with Russian organized crime. I learned about large fraudulent loans Parex was making to insiders. The amount of these loans was larger than the bank’s reported equity, indicating that the bank, in reality, had negative equity. I gave names and details to many institutions, including the US Embassy. Later, Parex was identified by the Spanish court in the Tambovskaya Mafia prosecution for providing platform money-laundering accounts to both of the two named money launderers for that Putin-linked gang. And after that, two of the insiders were named on the US Treasury Putin Warning List.

The result of my whistleblowing was that the US Embassy, and later also the US Treasury, refused to look at or even acknowledge receiving the information. They refused to communicate with me even though they had requested the information. Meanwhile, Latvian officials reacted by hosting Parex promotions at diplomatic premises in London and Switzerland so that Parex could borrow even more money, some of which was transferred to Eduard Khudainatov, who the US FBI later identified as a frontman holding assets in his name on behalf of Putin.

Since the insider loans predictably weren’t paid back, the Latvian government started secretly paying the EBRD to pretend to invest in Parex to dupe onlookers that Parex wasn’t looted even though it was. That deal was signed by Prime Minister Valdis Dombrovskis. Plus, Latvia made huge loans to Parex to fund movement of Parex accounts to sister bank ABLV and a new Parex successor Citadele. Latvian politicians blamed the resulting national financial collapse on the United States.

https://fintelegram.com/tag/ukio-bankKey people from Parex moved their activities to Ukio Bank Lithuania and Danske Bank Estonia, where they organized massive Putin-linked money laundering scams. When Ukio got looted, the EBRD got involved in intransparent ways. And, EBRD subsidiary Citadele employed a former Parex banker while he controlled the Marshall Islands company at the center of the money laundering at Danske.

Total money laundering at all of these institutions together was over one trillion dollars and euros making it the largest money laundering racket in world history. The Kremlin-linked bankers walked free with the money while Latvian taxpayers were tricked into bailing out Parex, Lithuanian taxpayers were tricked into bailing out Ukio, and Danish pensioners invested in Danske got hit with a huge penalty for money laundering they weren’t aware of. A 2018 Eurostat report indicates that Latvia is secretly paying the EBRD to pretend to invest in Citadele, which is the same thing Latvia and the EBRD did with Parex. This Citadele scam is still ongoing now in 2024.

How is it possible the US Treasury missed everything? I’ve written many articles for independent media websites. Independent journalists from several countries wrote articles for other media websites. I’ve been interviewed on many podcasts. I arranged to send letters and emails to several thousand people in relevant organizations. Two documentaries detailing the Parex and Citadele frauds were aired repeatedly on Latvian television (‘Jumts’) and ‘Jumts 2’), including interviews with me, evidence of the fraud, and statements by officials about the fraud. A third documentary by a different team has been completed and is starting distribution now. And, three thriller novels inspired by the fraud racket have already been written and published, all with different authors. Yet somehow the US Treasury doesn’t know what’s going on.

Where does the US Treasury get information from, if not from whistleblowers, media articles, and television? The sad answer is that they talk with politically connected lobbyists who get fat consulting fees from foreign governments.

The Blue Star Strategies Connection

One such lobbyist who worked for Latvia and ABLV is Sally Painter at Blue Star Strategies. She became a high-profile lobbyist working for Ukrainian citizens Dmytro Firtash and Ivan Fursin, who controlled RosUkrEnergo in Ukraine and Trasta Komercbanka in Latvia. This was about helping Putin, through Yanukovich, control the Ukrainian government. Then, she was employed at Parex. I know her, and I know, at least for Parex, her function was to convince the US Treasury not to impose sanctions.

She was an intermediary getting Hunter Biden on the board of Burisma of Ukraine. Blue Star Strategies was subpoenaed on suspicion that Burisma oligarch Mykola Zlochevsky was buying influence however so far nobody has been punished. And, Painter was intermediary getting former CIA agent Joseph Cofer Black on the board of Baltic International Bank of Latvia. She also secretly commissioned an article written by Anders Aslund of Atlantic Council praising ABLV.

Another person who worked as consultant helping ABLV in Washington was Daniel Glaser, former US Treasury Assistant Secretary for Terrorist Financing. Maybe Glaser somehow convinced US Treasury that ABLV specifically and Latvia generally had a crack-down and clean-up against the money launderers even though there wasn’t a crack-down or a clean-up?

And this leads us to a large hole in the defenses the United States: the modern practing of ‘box ticking’ exercises as a substitute for traditional law enforcement such as putting criminals in prison and seizing back stolen money.

The Egmont Group of Financial Intelligence Units (‘FIUs’) was founded in 1995. In 2003, the Financial Action Task Force ‘FATF’ established by the G7 issued explicit recommendations for countries to set up FIUs. As a result, by 2004, the Egmont Group had 94 members. One of the members is the FIU in Latvia.

The US Treasury sanctioned ABLV in early 2018 and Ilze Znotina became head of the Latvian FIU later in 2018 as part of a push by Latvia to give foreign governments the impression that Latvia is fighting money laundering. Znotina made a public comment when she joined the FIU that previously she had given information about irregularities at Parex Bank to Latvian authorities and the authorities ignored her. I was overjoyed at first, but soon the situation turned darker.

Latvian banks submit tens of thousands of Suspicious Activity Reports (‘SARs’) to the FIU every year. The FIU claims to review most of those but not all because of budget and staffing limitations. Anyway it seems not to matter whether they review all or none of the SARs because rampant unpunished corruption, fraud, and money laundering continue.

For example, the FIU appears unaware that the EBRD investments in Parex and Citadele weren’t real. They appear unaware of connections between money laundering at those two banks and three other key banks: ABLV, Ukio, and Danske. They appear unaware of Latvia’s ‘OIK’ system whereby intermediaries are inserted between payments from electricity consumers and the Latvenergo electricity utility. Some of those intermediaries are from the same Latvian Proxy Network of companies originally set up by an agent called International Overseas Services, which provided the thousands of shell companies used by Parex and ABLV.

The FIU appears unaware of the much-discussed ‘Construction Cartel’ in Latvia which overcharges the government on infrastructure projects. And, to give the clearest if not the largest example, the FIU appears unaware that Solaris Bus of Poland is bribing Dombrovskis’ political party. That was one part of my original whistleblowing, which I managed to get into one Latvian newspaper in 2007.

The Solaris bribery was discovered a second time by the US FBI and explained in a US Department of Justice settlement in 2010. And, the bribery was discovered a third time by Polish authorities in 2018. Meanwhile, the bribery had been moved from Parex to Citadele and then to the European Investment Bank as the amounts kept getting larger. This gives me an impression of the FIU as a room full of people wearing ties looking through stacks of SARs and ticking boxes while somehow blind to newspaper headlines.

Last but not least, something Znotina and the FIU were not interested in was the nine million euros transferred by a Cyprus company controlled by a Russian person who connected with Putin through ABLV and Danske Estonia to Anda Karina. Full details of this were leaked in 2019. Karina is the wife of Krisjanis Karins, who was Minister of the Economy at the time of my whistleblowing and who, by 2019, had become Prime Minister. He is in the same political party as Dombrovskis. I know Karins and Karina personally, and one reason why I chose to become a whistleblower against Parex years earlier was because I believed Karins would use the information to stop the fraud. Znotina and Karina are openly known to be long-time personal friends.

In 2022, Znotina left from the FIU. Currently, she works for an organization called AML Intelligence. Both with her previous job and her current job, she has been a regular speaker at international anti-money-laundering conferences talking about the supposedly excellent work Latvia’s FIU is doing. This makes her similar to Dombrovskis who, after signing the fake sale of a Parex stake to the EBRD, went on an international speaking tour to tell people at conferences about how he rescued Latvia.

The US Treasury should assign some fresh people to look at the situation in Latvia. When Latvia reacted to the disappearance of Parex assets by secretly paying the EBRD to pretend to invest, this was a red flag. When Latvia continued secretly paying the EBRD to protect Citdele, this was another red flag. When the US Treasury sanctioned ABLV and the proposed independent administrator was shot dead with a Kalashnikov in broad daylight in Riga and the Latvian government reacted by allowing ABLV to ‘self-liquidate,’ this was not a clean-up. Also, the ‘self-liquidation’ never happened. ABLV was only partly liquidated by transferring some assets to Citadele. Also, paying Washington lobbyists while funding an FIU that is unaware of major criminal rackets isn’t a clean-up.

The US Treasury has the power to tell Latvia and the EBRD to correct their accounting back to 2009 when the EBRD-Parex deal was signed. This can be the beginning of a real clean-up, and the whole world, including the United States, Europe, and especially Ukraine, will become safer.

Share Information

If you have any information regarding this report and the persons, companies, or activities mentioned, please let us know via our whistleblower system, Whistle42.